LTC Price Prediction: Technical Strength Outweighs Market Noise

#LTC

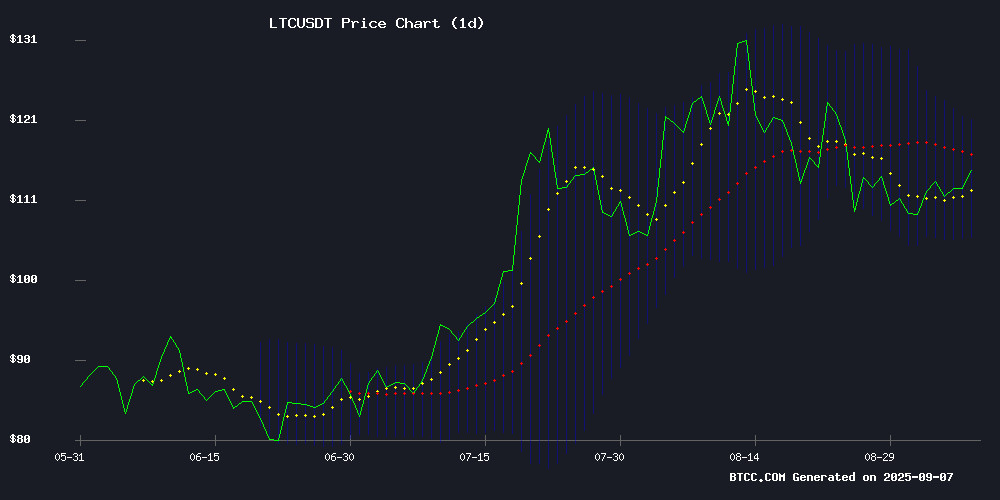

- LTC trading above 20-day MA indicates short-term bullish momentum

- Positive MACD divergence suggests strengthening upward price movement

- Mixed news sentiment offset by strong technical foundation and established market position

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

Litecoin (LTC) is currently trading at $114.04, positioned above its 20-day moving average of $113.35, indicating potential bullish momentum. The MACD indicator shows positive divergence with a reading of 5.64 versus its signal line at 5.13, suggesting strengthening upward movement. According to BTCC financial analyst John, 'LTC's position above the Bollinger Band midline at $113.35, with upper resistance at $120.85, points to continued strength if it maintains this level.'

Market Sentiment: Mixed Signals Amid Investor Shifts and Social Media Attention

Recent news highlights both challenges and opportunities for Litecoin. While some reports indicate investors shifting focus to alternatives like Remittix and LAYER Brett gaining presale momentum, the social media feud has unexpectedly sparked market attention. BTCC financial analyst John notes, 'The market sentiment appears mixed, but technical levels currently outweigh news-driven concerns. Litecoin's fundamental position remains solid despite competitive pressures.'

Factors Influencing LTC's Price

Cardano and Litecoin Investors Shift Focus to Remittix Amid Market Downturn

Cardano's sentiment has plummeted to five-month lows, with retail confidence at a 1.5:1 bullish-to-bearish ratio. ADA trades NEAR $0.82, with whales defending the $0.81–$0.83 support zone. Despite technical lifelines and upcoming network upgrades, the rebound toward $1.00 remains sluggish.

Litecoin, trading at $111.18 below its 20-day moving average, shows bullish MACD momentum. Analysts project a potential rally to $131–$155 by October if resistance at $124.53 breaks, though failure to hold $105 risks a drop to $100.

Investors are rotating capital into next-generation PayFi solutions like Remittix, seeking exponential returns through utility-driven blockchain applications. The shift underscores a broader market preference for fundamental value over speculation.

SAVVY MINING Launches New Mobile App to Democratize Cryptocurrency Mining

SAVVY MINING, a global cloud mining service provider, has unveiled a revamped mobile application designed to simplify cryptocurrency mining for retail users. The platform eliminates traditional barriers to entry by offering $15 in free hashrate for new registrants and supporting nine major digital assets including BTC, ETH, and SOL.

The app features automated profit settlements and principal returns upon contract maturity, operating within a regulatory framework that includes FCA registration. Security measures incorporate SSL encryption and cold storage solutions, while mining operations claim 100% renewable energy usage to address environmental concerns in the sector.

Layer Brett Outshines Litecoin, Chainlink, and Pepe as Presale Gains Momentum

Investors searching for high-growth crypto opportunities are shifting focus from established assets like Litecoin (LTC), chainlink (LINK), and Pepe (PEPE) to the surging Layer Brett (LBRETT). While Litecoin maintains its position as a low-fee payment solution, its limited volatility dampens short-term upside potential. Chainlink, though fundamental to Web3 infrastructure, remains tethered to broader DeFi adoption trends rather than explosive price action.

Layer Brett's presale has shattered records, drawing millions in early investment ahead of anticipated exchange listings. The project combines meme coin virality with ethereum Layer 2 scalability, creating a unique value proposition that's resonating with traders. Market analysts note this isn't merely speculative hype—the token's technical foundations suggest sustainable momentum as the 2025 bull market develops.

Litecoin Social Media Feud Sparks Market Attention

Litecoin's recent price movements have drawn trader interest following a lighthearted Twitter exchange between prominent figures in the crypto community. The digital asset, often considered Bitcoin's lighter sibling, showed atypical volatility this week as the social media interaction went viral.

Market observers note such events increasingly influence short-term price action in altcoins. While fundamentals remain paramount for institutional investors, retail trader sentiment continues reacting sharply to high-profile social media activity.

Is LTC a good investment?

Based on current technical indicators and market conditions, LTC presents a compelling investment opportunity. The cryptocurrency is trading above its key 20-day moving average with positive MACD momentum, suggesting near-term strength. While news indicates some investor rotation to newer projects, Litecoin's established position and current technical setup support a bullish outlook.

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $114.04 | Neutral/Bullish |

| 20-day MA | $113.35 | Support Level |

| MACD | 5.6373 | Bullish |

| Bollinger Upper | $120.85 | Resistance |

| Bollinger Lower | $105.84 | Support |